What’s the Difference

Between Term Life and

Universal Life Insurance?

Universal Life Insurance

Universal life insurance is a type of permanent life insurance policy that is generally more affordable than other options. In addition to providing a death benefit, universal life insurance also provides flexible premiums and includes a cash value savings component which can be used to supplement income and pay expenses.

Universal Life Insurance

Beyond affordability, universal life (UL) policies are also considered to be the most flexible kind of life insurance. Rather than simply providing a fixed death benefit amount for a fixed premium payment, UL policies offer policyholders flexibility with their premium payments and their death benefit amount.

People who own universal life insurance policies can make periodic adjustments according to their needs. UL policies also offer a built-in cash value, so you can set money aside on a tax-deferred basis, right inside your policy.

As you go through life, your insurance needs change.

Symmetry Financial Group provides plans to keep you protected.

Why Do I Need

Universal Life Insurance?

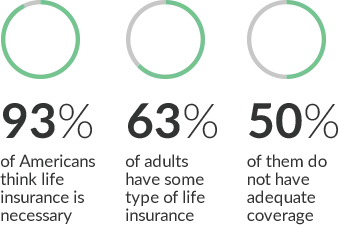

The reasons for buying universal life insurance are almost as varied as the number of policies available for purchase.

For most people, providing a ready source of funding for grieving loved ones after death is an important consideration. When you die, will your loved ones be able to afford to pay your final expenses and debts and be able to maintain their current standard of living? If the answer is "no", it's time to explore various life insurance options to determine what makes the most sense for your situation.

Why Do I Need

Universal Life Insurance?

The reasons for buying universal life insurance are almost as varied as the number of policies available for purchase.

For most people, providing a ready source of funding for grieving loved ones after death is an important consideration. When you die, will your loved ones be able to afford to pay your final expenses and debts and be able to maintain their current standard of living? If the answer is "no", it's time to explore various life insurance options to determine what makes the most sense for your situation.

How Does

Universal Life Insurance Work?

Just like other forms of insurance, you'll need to apply for coverage and pay an initial premium. Once your policy is in-force, you'll need to make periodic premium payments to keep your life insurance benefits.

One of the best features of universal life insurance is the flexibility with your premium. You can pay higher premiums to add to your policy's cash value when you're able. Or, if you need to reduce the premium for a period of time, you can make adjustments to the policy to accommodate that.

How Does

Universal Life Insurance?

Just like other forms of insurance, you'll need to apply for coverage and pay an initial premium. Once your policy is in-force, you'll need to make periodic premium payments to keep your life insurance benefits.

One of the best features of universal life insurance is the flexibility with your premium. You can pay higher premiums to add to your policy's cash value when you're able. Or, if you need to reduce the premium for a period of time, you can make adjustments to the policy to accommodate that.

Choose Symmetry For Universal Life Insurance

Symmetry Financial Group offers clients a different way to buy life insurance. Instead of trying to sell you one type of insurance, one company’s policy, or a specific death benefit amount, we get to know you first. We'll ask you a series of questions to help identify what your insurance needs are and what type of coverage will best help you meet those needs. From there, we have access to a variety of insurance providers and will work to find you a policy that meets both your goals and your budget.

To learn more, and to get started with insurance quotes to protect what's most important to you, contact us to begin working with a Symmetry Financial Group Agent today.

Would You Like to

Request a Quote?

Please fill out the short form so we can

provide you with the policy options to best

match your coverage and financial needs.

Frequently Asked Questions

Q: What are the advantages of Universal Life Insurance?

Universal life insurance is popular for many reasons.

- Affordability. Universal life insurance costs less than whole-life insurance policies.

- No-lapse protection. Some types of life insurance may lapse if you don't pay the premium on time. With universal life insurance, your policy includes some protection against lapsing by using the accumulated cash value to keep the policy in-force.

- Tax-advantaged savings. The cash value component of your universal life insurance policy provides a guaranteed minimum interest rate and offers tax-deferred accumulation.

- Premium payment flexibility. As your needs change, your universal life insurance policy premium payments and death benefits can be adjusted.

- Loan and withdrawal features. You may be able to take out loans or withdrawals from the accumulated policy cash value when you need them, which may be an attractive alternative to borrowing from a financial institution.

Q: Do I qualify for Universal Life Insurance?

When you apply for any type of life insurance policy, you'll need to answer questions about your health, including any medical conditions you have been diagnosed with or treated for. You'll also be asked questions about your occupation and lifestyle. The insurance company evaluates this information in determining whether to approve your new insurance policy. Many universal life insurance policies are offered with limited underwriting requirements, meaning you may not need to complete a physical examination as part of the application process.

Q: Can I afford Universal Life Insurance?

Premiums for universal life insurance policies are typically higher than term insurance, but less expensive than premiums for whole life insurance policies. The price you pay will depend on the face amount of the policy (the amount of the death benefit payable after your death), your age at the time you apply, and your overall health. If you are a non-smoker, your premiums will generally be less expensive than those paid by regular tobacco users.

One of the biggest benefits of universal life insurance is the built-in flexibility when it comes to your premiums. If you experience a temporary financial hardship after your policy has been in force for a certain length of time and have sufficient cash value inside your policy, you may be able to rely on that cash value temporarily to help you keep the policy in force until you can afford to resume the full premium amount again.

Q: When should I buy Universal Life Insurance?

Universal life insurance is a smart choice for people who want some flexibility with their life insurance policies. Because your premiums will be based on your attained age and health at the time you apply, there's no better time to apply than the present.

Core Values

Our eight core values are the

driving force behind everything we do.

Largest Life Insurance Guide

Read our comprehensive guide to answer any life insurance questions you have.

Interactive Timeline

View our interactive timeline to

see what insurance is right for you

CONTACT US

DEBT FREE LIFE

Learn more about Symmetry Financial Group’s Debt Free Life program, which

can help you get out of debt in nine

years or less without spending any additional money.

PRODUCTS

• Mortgage Protection

• Final Expense

• Term Life Insurance

• Universal Life Insurance

• Disability Insurance

• Critical Illness Insurance

• Retirement Protection

• SmartStart Insurance

WHY SYMMETRY?

Copyright © 2025 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Lisa Rednour. No offers, solicitations or recommendations are being made via this website in any state where one of those named Quility licensees does not have a license. Please see our License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Stephen J. Brenes’s license numbers in each state.

CONTACT US

DEBT FREE LIFE

Learn more about Symmetry Financial Group’s Debt Free Life program, which

can help you get out of debt in nine

years or less without spending any additional money.

Lisa Rednour

Copyright © 2025 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Lisa Rednour. No offers, solicitations or recommendations are being made via this website in License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Lisa Rednour’s license numbers in each state.

No agent’s success, earnings, or production results should be viewed as typical, average, or expected. Not all agents achieve the same or similar results, and no particular results are guaranteed. Your level of success will be determined by several factors, including the amount of work you put in, your ability to successfully follow and implement our training and sales system and engage with our lead system, and the insurance needs of the customers in the geographic areas in which you choose to work.

custom_values.agent_bio=Lisa Rednour has many years of experience in the Insurance industry and truly enjoys helping people protect what is most valuable to them, as well as seeing their faces and reactions when they begin to pay off debt. I love educating young Men and Women on the newest ways of growing wealth and retirement, and changing their futures with a few tweaks. I am a Family oriented person, and have been married 34 years, 4 Children,5 Grandchildren and loving life!

custom_values.agent_brokerage=

custom_values.agent_headshot=

custom_values.agent_name=Lisa Rednour

custom_values.agent_phone=(404) 391-4079

custom_values.agent_title=

custom_values.agentemail=

custom_values.booking_page_link=

custom_values.booking_thank_you_page=

custom_values.brag_link=

custom_values.claim_thank_you_page=

custom_values.confirm_sale=

custom_values.final_expense_booking_page=

custom_values.from_email=

custom_values.insurance_license_number=

custom_values.life_insurance_landing_page=

custom_values.logo_image_url=

custom_values.outbound_email=

custom_values.recruiting_booking_link=

custom_values.twilio_number=(404) 941-1662

custom_values.twilio_number_in_link_form=Tel:(404) 941-1662

custom_values.licensenumber=

rednouragency@gmail.com

SFG0011187

(404) 941-1662

Tel:(404) 941-1662

UBd4h9QnJKlBa7hfNXMc